Employment Law Update - March 2021

The Fair Work Amendment (Supporting Australia’s Jobs and Economic Recovery) Bill 2020 (the Omnibus Bill)

Under Scott Morrison’s leadership, the Fair Work Amendment (Supporting Australia’s Jobs and Economic Recovery) Bill 2020 was introduced into Federal Parliament seeking to make amendments to the current industrial landscape following a lengthy period of consultation with all stakeholders. Aspiring to its call card, the ‘Omnibus Bill’ touches on several issues that have arisen out of:

common law uncertainty regarding casual employment;

the COVID-19 pandemic;

zombie industrial agreements; and

a surge of large organisations self-reporting underpayments.

On 9 December 2020 the Omnibus Bill was read for a first time by the House of Representatives and has been referred to the Senate Education and Employment Legislation Committee with a report due 12 March 2021. It is anticipated that the bill will be re-introduced to the Senate in the week commencing 15 March 2021.

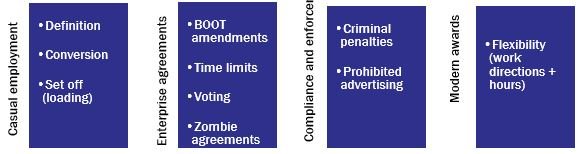

OVERVIEW:

Most relevantly the proposed changes may be broken into four categories:

CASUAL EMPLOYMENT

Defining a casual

This issue of casual employment has been front and centre since 2018 following the decision of Workpac v Skene [2018] FCAFC 131. The definition of a casual was loosened which included a series of indicia:

No firm commitment to the other party;

Irregular work patterns;

Lack of continuity;

Intermittency of work; and

Unpredictability and uncertainty as to the period of employment. [1]

Only two years later, Workpac v Rossato [2020] FCAFC 84 (‘Rossato’) varied the test and provided that even though there was an absence of a ‘firm advance commitment’ of employment and hours the employment contract as a whole should be considered in respect of the following factors:

whether the employment was regular or intermittent;

whether it permitted the employer to elect to offer employment on a particular day;

whether it permitted the employee to elect to work on a particular day;

the duration of the employment; and

the description provided by the parties as to the relationship, although this was not conclusive (that is, whether it was described as casual or permanent in the contracts). [2]

Rossato also dealt with the issue of whether the 25% casual loading could be used to offset the claims and the Full Court made it difficult for this to apply. This aspect of the decision has caused consternation as the effect of the decision was that casual workers would be entitled to be double compensated in respect of their entitlements.

Defining a casual - Omnibus amendments

The proposed amendment of section 15A(1) of the Fair Work Act, 2009 (Cth) (‘FW Act’) would now define a casual if:

an offer of employment is made on the basis that the employer makes “no firm advance commitment to continuing and indefinite work according to an agreed pattern of work for the person” (this entrenches the principles espoused in the above two decisions);

the person accepts the offer on that basis; and

the person is an employee as a result of that acceptance.

The Bill then proposes a proscriptive test as to whether or not an employer has made ‘no firm advance commitment to continuing an indefinite work according to an agreed pattern of work’ whereby the court must have regard only to the following considerations:

whether the employer can elect to offer work and whether the person can elect to accept or reject work;

whether the person will work only as required;

whether the employment is described as casual employment; and

whether the person will be entitled to a casual loading or a specific rate of pay for casual employees under the terms of the offer or a fair work instrument.

This significantly narrows and attempts to codify the recently created common law test for casual employment.

Offset clause

The proposed s 545A attempts to strengthen the ability to offset the casual loading. Section 545A(2) states that a court must reduce any amount payable with respect to an entitlement by the amount equal to the loading. The amount of the reduction may be a proportionate amount if the court considers it appropriate but only having regard to the following elements:

the industrial instrument or the contract specifies the relevant entitlements the loading amount is compensating for and the proportion of the loading amount attributable to each entitlement; or

if the instrument or contract does not specify the proportion for each entitlement, then the court can determine the amount; or

if there is no clause, then an appropriate amount.

The entitlements that can be offset by the casual loading include all leave entitlements, payment in lieu of notice and redundancy pay.

Employer offers

Pursuant to s 66B Employers must make an offer for casual conversion in writing if:

the employee has been employed by the employer for a period of 12 months beginning the day the employment started; and

during at least the last 6 months of that period, the employee has worked a regular pattern of hours on an ongoing basis which, without significant adjustment, the employee could continue to work as a full-time employee or a part-time employee (as the case may be).

However, the offer does not need to be made if there are ‘reasonable grounds’ not to make the offer after considering the following factors:

the employee’s position will cease to exist within 12 months of the offer which is due to be made;

the hours to be worked will be significantly reduced in that period;

there will be a significant change the hours or days of work;

the making of the offer would not comply with a Government recruitment policy.

The employee then has 21 days in which to provide a response in writing. Furthermore, pursuant to s 66F an employee can request to be converted to a permanent role so long as they have not previously rejected an offer of casual conversion.

It is proposed that the casual conversion requirements will commence 6 months after the commencement of the Act.

ENTERPRISE AGREEMENTS

Better Off Overall Test (‘BOOT’)

The Omnibus Bill seeks to suspend the use of the BOOT during the COVID-19 pandemic. Section 189(2) will be amended to permit the Commission to approve an enterprise agreement (that is not a greenfields agreement) if it is satisfied that it is appropriate to do so taking into account:

the views of employees and employer;

the circumstances of the employees;

the impact of COVID-19;

the extent to which the employees supported the agreement during the voting; and

the approval of the agreement would be in the public interest.

Amendments are also proposed to s 193 of the FW Act so as to provide a list of matters that the Commission may have regard to when determining whether an EA has passed the BOOT. The relevant matters are:

patterns or kinds and types of work as compared to the relevant award;

the overall benefits that an award covered employee would receive under the agreement when compared to a modern award; and

the views of employers, employees, representatives as to whether the agreement passes the BOOT.

Casuals and voting re: Enterprise agreements

The Omnibus Bill seeks to amend s 216A of the FW Act by tightening which casuals may be eligible to vote on the resolution of enterprise bargaining agreements. That is, only casual employees who performed work at any time during the access period for the variation are eligible to vote on the variation.

The Bill also operates to create a sunset clause for any transitional agreement that have not been terminated prior to will be terminated on 1 July 2022.

COMPLIANCE AND ENFORCEMENT

A number of amendments have been proposed including increasing the small claims jurisdiction of the Federal Circuit Court to $50,000.00 from $20,000.00 and all matters must be referred to conciliation before the Fair Work Commission.

Further amendments have included making it a civil penalty offence to advertise employment with pay rates less than the national minimum wage and to increase the maximum civil penalty to 90 penalty units (being $19,980.00).

However, the most significant amendment has been to criminalise the breaches of the FW Act. If an employer dishonestly engages in a systematic pattern of underpaying one or more employees, they could be liable for criminal sanctions. ‘Dishonest’ has been defined by reference to the standards of ‘ordinary people’ and known by the employer to be dishonest ‘according to the standards of ordinary people’. The proposed new s 324B of the FW Act will include consideration of whether the employer engaged in a systematic pattern of underpaying employees.

The penalties have been increased such that for an individual it is 4 years imprisonment and/or 5,000 penalty units ($1.11 million) and 25,000 penalty units ($5.55 million) for all body corporates.

MODERN AWARDS

Simplified additional hours

Under the proposed s 161M a simplified additional hours agreement may be made which applies only to part-time workers under specific Awards including:

Business Equipment Award 2020;

Commercial Sales Award 2020;

Fast Food Industry Award 2010;

General Retail Industry Award 2020;

Hospitality Industry (General) Award 2020;

Meat Industry Award 2020;

Nursery Award 2020;

Pharmacy Industry Award 2020;

Restaurant Industry Award 2020;

Registered and Licensed Clubs Award 2010;

Seafood Processing Award 2020; and

Vehicle Repair, Services and Retail Award 2020.

Furthermore, the employer must not require the employee to enter into a simplified additional hours agreement. The employer must reduce the agreement to writing, inform the employee that this is a simplified additional hours agreement and keep a copy of the agreement or record. The agreement can be terminated on 7 days notice in writing.

Flexibility work directions

In a more permanent response to the COVID-19 pandemic, an employer has the flexibility to issue work directions as to the nature and location of work (being flexible work directions and flexible work location directions).

The proposed s 789GZG is designed to operate so as to allow an employer to give a flexible work direction to an employee to perform any duties during a period that are within the employee’s skill and competency if:

those duties are safe, having regard to (without limitation) the nature and spread of COVID-19; and

the employee has the necessary licence or qualification; and

those duties are reasonably within the scope of the employer’s business operations.

Similar to the flexible work directions, there is a proposed change relating to flexible work location directions (section 789GZH) which allows employers to give a lawful direction to employees to work from another location (including the home) if:

the place is suitable for the employee’s duties; and

it does not require the employee to travel long distances;

the performance of the employee’s duties at the place is safe, and reasonably within the scope of the employer’s business operations.

Finally, there is a proposed 2 year sunset clause for this section.